Investing in Cannabis,

Made Simple

When looking to invest in cannabis, you have a few options. We offer investments across a diverse set of alternative asset classes including private placements, private funds, and even crowdfunding. Discover which option is right for you.

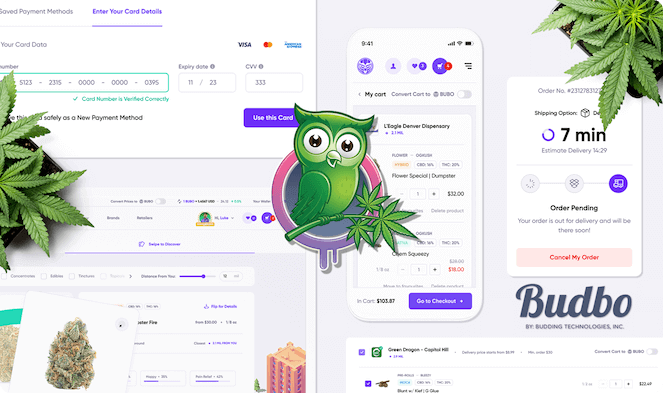

Company Spotlight

Budbo is a complete technology solution that benefits cannabis dispensaries, growers, couriers, and users. Its functionality goes beyond seed-to-sale tracking by normalizing the cash-intensive marketplace, powering revenue for merchants and enabling consumers to enjoy a speedy, convenient, and safe cannabis marketplace.

$493.95

Minimum Investment

Reg CF – $1.85 price per share

We Offer A Few Different Investment Options To Suit Your Needs

We’re delighted that you’re considering one or more of the issuers currently accepting investments. Before you invest, review the information below to find out which types of investments work best for your needs.

Crowdfunding

Crowdfunding is using small amounts of capital from a large number of individuals to finance a new business venture or grow an existing one. Crowdfunding brings investors and entrepreneurs together by expanding the pool of investors beyond the traditional circle of owners, relatives, and venture capitalists. In return for an investment, backers receive equity shares of the company.

Private Funds

An investment in a private fund can take the form of debt or equity. Many, but not all, focus on private, non-public companies in their investing mandate. When an investor allocates to a private fund, they will receive shares or units of that fund. Private funds may also invest in public securities but will generally utilize an alternative investment approach, like a long/short hedge fund.

Private Placements

A “private placement” is a private alternative to issuing, or selling, a publicly offered security as a means for raising capital. In a private placement, both the offering and sale of debt or equity securities is made between a business, or issuer, and a select number of investors. Both public and private companies use the private placement market for a variety of reasons, including a desire to access long-term, fixed-rate capital, diversify financing sources, add additional financing capacity beyond existing investors (banks, private equity, etc.), or, in the case of privately held businesses, to maintain confidentiality.

Ei. Ventures

Psychedelics and plant Medicines

$20,435,292 / $49,999,999

RAISED

$498.94

Min. Investment

$4.94

Share Price

40,80%

COMPLETE

MJ Real Estate Investment Trust

MJ REIT focuses on commercial real estate whose tenants operate in the state legal cannabis industry. Diversifying with private real estate has the potential to create a more a efficient portfolio.

$25,000

Minimum Investment

506(c) – Accredited Investors Only

All Companies

MJ Real Estate Investment Trust

Commercial real estate

506(c) – Accredited Investors Only

$25,000

Min. Invest

Budbo

Global platform for all things cannabis

Reg CF – $1.85 price per share

$493.95

Min. Invest